Are you paying a ton on rent? Do you plan on sticking around Austin for a while? Do you have a stable job? Then the answer is easy. You probably can and should buy. I’ll tell you why. You should be putting your money into your own home, not into something you rent temporarily! If you live in Austin, you’re paying too much in rent each month and throwing away hard earned cash. Unless you live with a couple of roommates and get creative, odds are, your monthly mortgage payment will be less or about the same as what you pay in rent. With a stable job, loan approval will be easier to obtain, and that’s half the battle.

Before you start looking at houses, evaluate your personal and financial situation. Not everyone reading this needs to buy a property. Depending on your financial and personal situation and how you intend to create a better lifestyle for yourself and your loved ones. Everyone wants homeownership for different reasons. Personally, I noticed that the people I considered successful owned at least one property, and I wanted to find out the reasons why.

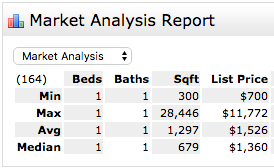

Reason number one: Rent is the worst. Yes, shelter is one of your basic needs, but does that basic need have to eat away at 15-30% of your yearly earnings? You are throwing away money each month while leasing. The average rent for a one bedroom in central Austin is about $1,360 a month or $16,320 a year. You will never see this money again. Instead of throwing away $1,360 or more each month on rent, you could own a property with a $1,360 or less fixed monthly payment AND gain equity on your property. Equity is the amount of money you have put into your property and what you get back when you sell it. Remember, rent increases with inflation, but your mortgage payment is fixed! Check out my article “To Rent, Or Not To Rent?” to test out the rental calculator with your personal information. You can see what’s best for you.

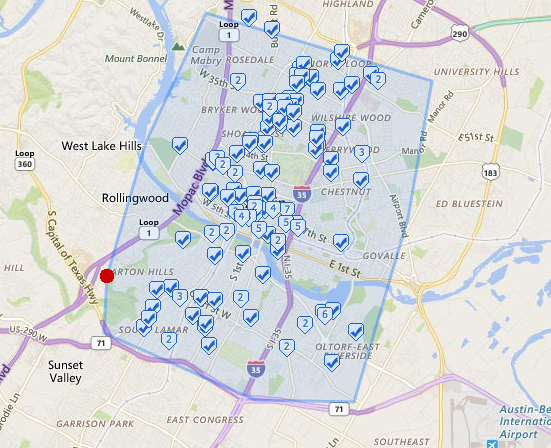

The parameter I considered to be “Central Austin”.

Reason number two: Control. When you own the property that you live in, you call the shots. This guarantees the absence of property managers and landlords; thus no more people telling you what you can and can’t do. Want to paint your walls? Do it. Want to plant a garden in the yard? Go for it! Want a trampoline in your yard? Why the hell not?! I don’t know about you, but I want the freedom to do projects in my house without somebody breathing down my neck.

Reason number three: Passive Income through rental properties. Passive income is income received on a regular basis, with little effort required to maintain it. Passive income is a great retirement plan, especially when you don’t have a pension. Start saving now! Also, it is the key to a well-balanced life. The common denominator of successful people is making their money work for them. Want to have a career and family with time left for friends, traveling, and community involvement? Yeah, me too! Work less, make more money and have more time. Whether that be spending time with your family, getting involved in your community, or drinking a margarita at the beach on a Monday afternoon. Although your first home may not be an investment property, it will get you more familiar with the real estate world, and possibly one step closer in that direction.

You can learn more about passive income from the book “Rich Dad Poor Dad” and BiggerPockets.com

Bottom Line: Don’t overcomplicate this. If you are ready, willing, and able to buy a home, waiting will only hurt you in the long run. We all fear the unknown, and no matter how much information you collect, you’ll never really know everything until you go out and experience it for yourself. If you’d like to talk more about your options feel free to reach out!

Featured photo: Flickr user Mark Moz, creative commons licensed.

Originally published on LinkedIn. Republished with permission.